How Banking Can Survive Digital Disruption

- by 7wData

The disruptors in the banking industry are rewriting the rules followed for decades. But, these new rules will only suffice until the next wave of disruption comes along. As a result, banks and credit unions must be agile and responsive. Bold strategies are required.

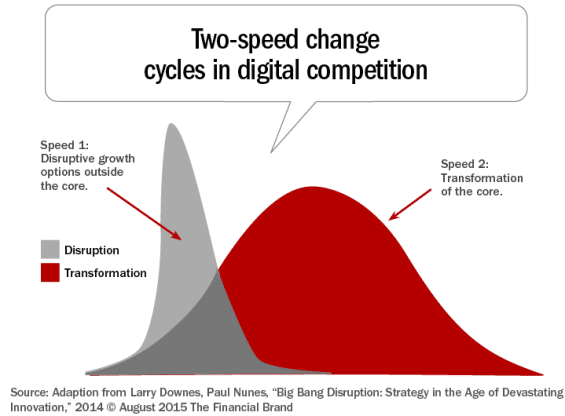

Digital disruption is occurring at every level of the financial services industry. New competitors, new channels, new processes and new consumer expectations are shifting the banking industry paradigm. In response, banking executives are balancing the need to be an agile responder, while realizing that many of the changes required will take time.

“Instead of the traditional bell curve response of a typical product or service life cycle, a series of quick-fire innovations has produced a ‘shark fin’ business model, where disruptive products or services are embraced and discarded in fast succession,” Accenture states in their report, ‘Digital Strategy Execution Drives a New Era of Banking‘. Referencing research done by Larry Downes and Paul Nunes, (Big Bang Disruption, Strategy in the Age of Devastating Innovation), Accenture states that such rapid digital innovation cycles have the potential to drive up return on equity (ROE) by more than 5% for both mature or emerging market banks.

Beyond the profit potential, this rapid innovation cycle is imperative as mature products get replaced by new technologies and shorter product life cycles. It is also important now that entire product lines are being created or destroyed overnight by these ‘Big Bang’ disruptors. As we have seen throughout the financial services industry, digital disruption can come out of nowhere and instantly be everywhere.

Larry Downes and Paul Nunes make that case that, unlike previous disruption, where being cheaper than established offerings was the way to move market share, today’s disruptors are more inventive and better integrated with other products and services. In addition, they found that many new entrants exploit consumers’ growing access to product information and their ability to contribute to and share it.

As competitive pressures increase, Accenture believes it’s critical to execute at two speeds to sustain market momentum while also strengthening the core underpinning of a bank or credit union.

Speed 1. Disruptive growth options outside the core: Moving at disruptive speed means being able to move at the speed of the new entrants that are making headlines. Organizations such as PayPal, Amazon, Apple, etc. are building financial services that work beyond the traditional boundaries of banking … and are doing so quickly.

Many of the most recent disruptions in financial services feature virtually integrated solutions … they are developed and deployed via the infrastructure of the cloud. With this agile and well-funded competition, traditional operational and organizational assets (systems, size, distribution network) suddenly morph into liabilities.

Accenture refers to many of these types of solutions as being the core of a consumer’s Everyday Bank. Growth ‘outside the core’ requires the banking industry to be able to disrupt itself, creating new options that may involve partnerships with non-financial firms. The culture must become entrepreneurial while being accepting of greater uncertainty.

Examples of ‘disruptive growth’ according to Accenture could include:

Speed 2. Transformation of the core: While pursuing the rapid-fire components of disruptive growth outside the core, Accenture believes successful digital banking organizations must also move at a more deliberate pace to transform three elements of their underlying core:

Transformation of the core will require shifts and redeployment of resources, people and technology and will result in new operating models and new digital ecosystems.

[Social9_Share class=”s9-widget-wrapper”]

Upcoming Events

Evolving Your Data Architecture for Trustworthy Generative AI

18 April 2024

5 PM CET – 6 PM CET

Read MoreShift Difficult Problems Left with Graph Analysis on Streaming Data

29 April 2024

12 PM ET – 1 PM ET

Read More