A digital revolution in health care is speeding up

- by 7wData

WHEN someone goes into cardiac arrest, survival depends on how quickly the heart can be restarted. Enter Amazon’s Echo, a voice-driven computer that answers to the name of Alexa, which can recite life-saving instructions about cardiopulmonary resuscitation, a skill taught to it by the American Heart Association. Alexa is accumulating other health-care skills, too, including acting as a companion for the elderly and answering questions about children’s illnesses. In the near future she will probably help doctors with grubby hands to take notes and to request scans, as well as remind patients to take their pills.

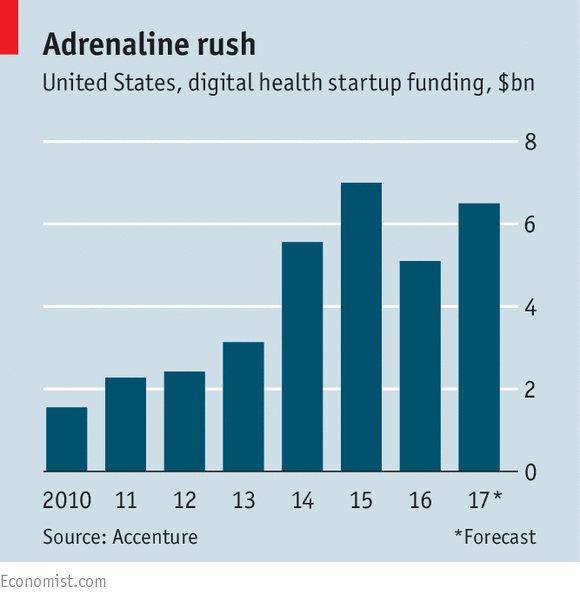

Alexa is one manifestation of a drive to disrupt an industry that has so far largely failed to deliver on the potential of digital information. Health care is over-regulated and expensive to innovate in, and has a history of failing to implement ambitious IT projects. But the momentum towards a digital future is gathering pace. Investment into digital health care has soared (see chart).

One reason for that is the scale of potential cost-savings. Last year Americans spent an amount equivalent to about 18% of GDP on health care. That is an extreme, but other countries face rising cost pressures from health spending as populations age. Much of this expenditure is inefficient. Spending on administration varies sevenfold between rich countries. There are huge differences in the cost of medical procedures. In rich countries about one-fifth of spending on health care goes to waste, for example on wrong or unnecessary treatments. Eliminating a fraction of this sum is a huge opportunity.

Consumers seem readier to accept digital products than just a few years ago. The field includes mobile apps, telemedicine—health care provided using electronic communications—and predictive analytics (using statistical methods to sift data on outcomes for patients). Other areas are automated diagnoses and wearable sensors to measure things like blood pressure.

If there is to be a health-care revolution, it will create winners and losers. Andy Richards, an investor in digital health, argues that three groups are fighting a war for control of the “health-care value chain”.

One group comprises “traditional innovators”—pharmaceutical firms, hospitals and medical-technology companies such as GE Healthcare, Siemens, Medtronic and Philips. A second category is made up of “incumbent players”, which include health insurers, pharmacy-benefit managers (which buy drugs in bulk), and as single-payer health-care systems such as Britain’s NHS. The third group are the technology “insurgents”, including Google, Apple, Amazon and a host of hungry entrepreneurs that are creating apps, predictive-diagnostics systems and new devices. These firms may well profit most handsomely from the shift to digital.

The threat to the traditional innovators is that as medical records are digitised and new kinds of patient data arrive from genomic sequencing, sensors and even from social media, insurers and governments can get much better insight into which treatments work. These buyers are increasingly demanding “value-based” reimbursement—meaning that if a drug or device doesn’t function well, it will not be bought.

The big question is whether drug companies will be big losers, says Marc Sluijs, an adviser on investment in digital health. More data will not only identify those drugs that do not work. Digital health care will also give rise to new services that might involve taking no drugs at all.

Diabetes is an obvious problem for the pharma business in this regard, says Dan Mahony, a partner at Polar Capital, an investment firm. Since evidence shows that exercise gives diabetics better control of their disease (and helps most pre-diabetics not to get sick at all), there is an opening for new services. UnitedHealthcare, a big American insurer, for example, has a prevention programme that connects pre-diabetics with special coaches at gyms.

[Social9_Share class=”s9-widget-wrapper”]

Upcoming Events

Evolving Your Data Architecture for Trustworthy Generative AI

18 April 2024

5 PM CET – 6 PM CET

Read MoreShift Difficult Problems Left with Graph Analysis on Streaming Data

29 April 2024

12 PM ET – 1 PM ET

Read More